Householders insurance coverage is crucial in safeguarding your property, private belongings, and funds from unexpected occasions, reminiscent of pure disasters, theft, or injury. Nevertheless, figuring out the suitable quantity of protection might be difficult for a lot of householders. This fast information will look at the important thing elements that affect the mandatory protection, together with location, age, and situation of the property, private property and legal responsibility protection wants, and extra.

For example, cities reminiscent of Miami, Houston, and Los Angeles are liable to pure disasters like hurricanes, floods, and wildfires, respectively, which might have an effect on the price of insurance coverage protection. With this fast information, you’ll be higher geared up to judge your protection wants and select the suitable coverage to make sure that your property and private belongings obtain sufficient safety.

Understanding householders insurance coverage

Step one in figuring out how a lot householders insurance coverage you want is to grasp the fundamentals of house owners insurance coverage. Householders insurance coverage is a sort of insurance coverage that gives monetary safety in opposition to injury or loss to your property and private property. Most traditional insurance policies present protection for damages attributable to hearth, theft, vandalism, and sure pure disasters. Householders insurance coverage also can present legal responsibility protection, which protects you if somebody is injured in your property and you’re discovered accountable.

It’s necessary to grasp the totally different protection choices out there to you when deciding on a coverage. Commonplace insurance policies could have limits on protection, and extra protection choices could also be mandatory relying in your particular wants. It’s additionally necessary to grasp the bounds of protection, which might differ relying on the coverage and insurance coverage supplier. Within the subsequent part, we’ll focus on the elements that have an effect on the quantity of protection you want.

Elements that have an effect on the quantity of protection wanted

A number of elements can affect the quantity of protection you want in your householders insurance coverage coverage. The placement of your property, the age and situation of your property, the fee to rebuild or restore the property, and your private property and legal responsibility protection wants are all elements to think about when assessing your protection wants.

Location of your property

The placement of your property can affect the price of your householders insurance coverage coverage. In case your property is situated in an space liable to pure disasters, it’s possible you’ll want extra protection to adequately defend your property and private belongings. In truth, in line with a latest survey from Policygenius, many householders could not have sufficient insurance coverage to rebuild their houses within the occasion of a catastrophe. The survey discovered that over 60% of house owners haven’t up to date their insurance coverage protection previously 12 months, leaving them weak to gaps in protection as a consequence of inflation and different elements. To make sure that you could have sufficient householders insurance coverage to rebuild after a catastrophe, it’s necessary to evaluate your protection wants recurrently and alter your protection limits accordingly.

Age and situation of your property

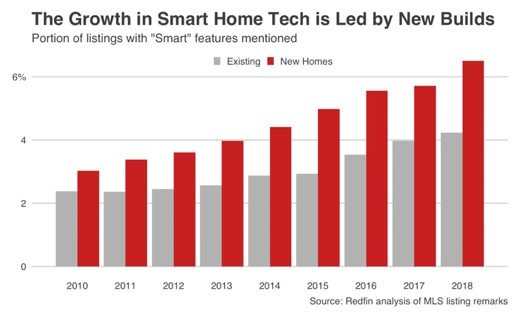

The age and situation of your property also can affect your protection wants. Older houses could require extra protection because of the elevated threat of injury or loss, and newer houses could require much less protection. Moreover, when you’ve got made upgrades or renovations to your property, it’s possible you’ll want extra protection to guard the elevated worth of your property.

Price to rebuild or restore your property

The fee to rebuild or restore your property is one other necessary issue to think about when figuring out your protection wants. The fee to rebuild or restore your property can differ relying on elements such because the sq. footage of your property, the supplies used to construct it, and the situation of your property. It’s necessary to make sure that your protection restrict is enough to cowl the price of rebuilding or repairing your property within the occasion of a loss.

Private property and legal responsibility protection

Lastly, your private property and legal responsibility protection wants also needs to be considered when figuring out your protection wants. Private property protection protects your private belongings, reminiscent of furnishings, electronics, and clothes, whereas legal responsibility protection protects you if somebody is injured in your property, and you’re discovered accountable.

Assessing your protection wants

Assessing your protection wants is a necessary step in figuring out how a lot householders insurance coverage you want. To find out the quantity of protection wanted, it is best to calculate the worth of your property and private belongings and think about your legal responsibility protection wants.

Calculating your property worth

To calculate the worth of your property, you should use a house worth estimator instrument to see how a lot your property is value or seek the advice of an expert appraiser. It’s necessary to make sure that your protection restrict is enough to cowl the price of rebuilding your property within the occasion of a loss. Moreover, it is best to think about the worth of your private belongings, together with furnishings, electronics, clothes, and different objects.

Figuring out legal responsibility protection

When figuring out your legal responsibility protection wants, think about the potential dangers related along with your property. When you continuously entertain visitors or have a pool or different leisure tools in your property, it’s possible you’ll want extra legal responsibility protection to guard your self within the occasion of an accident.

After getting assessed your protection wants, it’s necessary to judge and alter your protection limits accordingly. Usually reassessing your protection wants may help guarantee that you’ve got sufficient safety in your residence, private belongings, and funds.

Choosing the proper householders insurance coverage coverage

Choosing the proper householders insurance coverage coverage is an important step in guaranteeing that you’ve got the protection it is advisable to defend your property and private belongings. When deciding on a coverage, it is best to examine totally different coverage sorts and perceive deductibles and premiums.

There are a number of varieties of householders insurance coverage insurance policies out there, together with fundamental, broad, and particular type insurance policies. Primary insurance policies present protection for particular named perils, whereas broad insurance policies present protection for a wider vary of perils. Particular type insurance policies present protection for all perils, aside from these particularly excluded within the coverage.

Deductibles and premiums are additionally necessary concerns when selecting a coverage. A deductible is the quantity you’ll have to pay out of pocket earlier than your insurance coverage protection kicks in. Increased deductibles can decrease your premiums, however can also enhance your out-of-pocket bills within the occasion of a loss.

When evaluating premiums, it’s important to think about the protection limits and deductibles related to every coverage. A decrease premium could seem enticing, however it might additionally present decrease protection limits or increased deductibles.

It’s additionally important to rigorously learn the phrases and circumstances of every coverage earlier than making a call. Understanding the particular phrases and exclusions of a coverage may help you choose a coverage that most closely fits your wants.

How a lot householders insurance coverage do you want? Backside line

Figuring out how a lot householders insurance coverage you want is a vital step in defending your property, private belongings, and funds from sudden occasions. Elements reminiscent of the situation of your property, the age and situation of your property, the fee to rebuild or restore your property, and your private property and legal responsibility protection wants all play a job in figuring out the quantity of protection you want.

To evaluate your protection wants, it’s necessary to calculate the worth of your property and private belongings and think about your legal responsibility protection wants. After getting decided your protection wants, you may select a coverage that gives sufficient safety in your residence and private belongings. Additionally, recurrently reassessing your protection wants and adjusting your protection limits accordingly may help guarantee that you’ve got the safety it is advisable to climate sudden occasions.