Among the many numerous in style funding apps, one of many buzziest is definitely Acorns.

By means of the Acorns app, you may financial institution, save, and begin investing with simply your spare change or extra.

With superstar backers similar to Ashton Kutcher, Dwayne Johnson, and Kevin Durant (plus a bunch of well-known company names), Acorns’ web site studies it has grown to 9 million subscribers.

Do you have to be certainly one of them?

Utilizing Acorns to Make investments

Like its rivals, similar to Constancy, Vanguard, Betterment, E*TRADE, and newer rivals like Robinhood and M1 Finance, Acorns simplifies the trail to investing by providing a user-friendly interface.

And in Acorns’ case, extraordinarily low limitations to entry.

Enroll with Acorns, and get a $20 bonus!

By means of Acorns, one can put money into a variety of low-fee ETFs (Alternate Traded Funds), representing each equities and bonds.

Most just lately, their funding choices have broadened to incorporate an ESG (setting, social, governance)-themed ETF possibility.

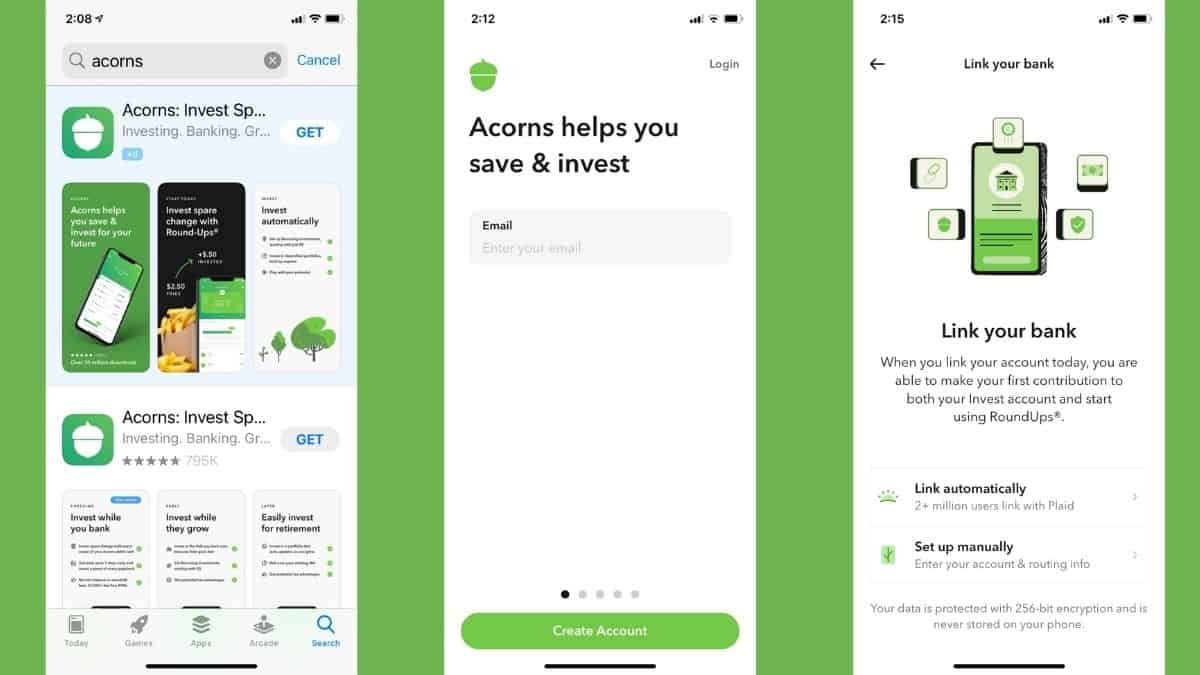

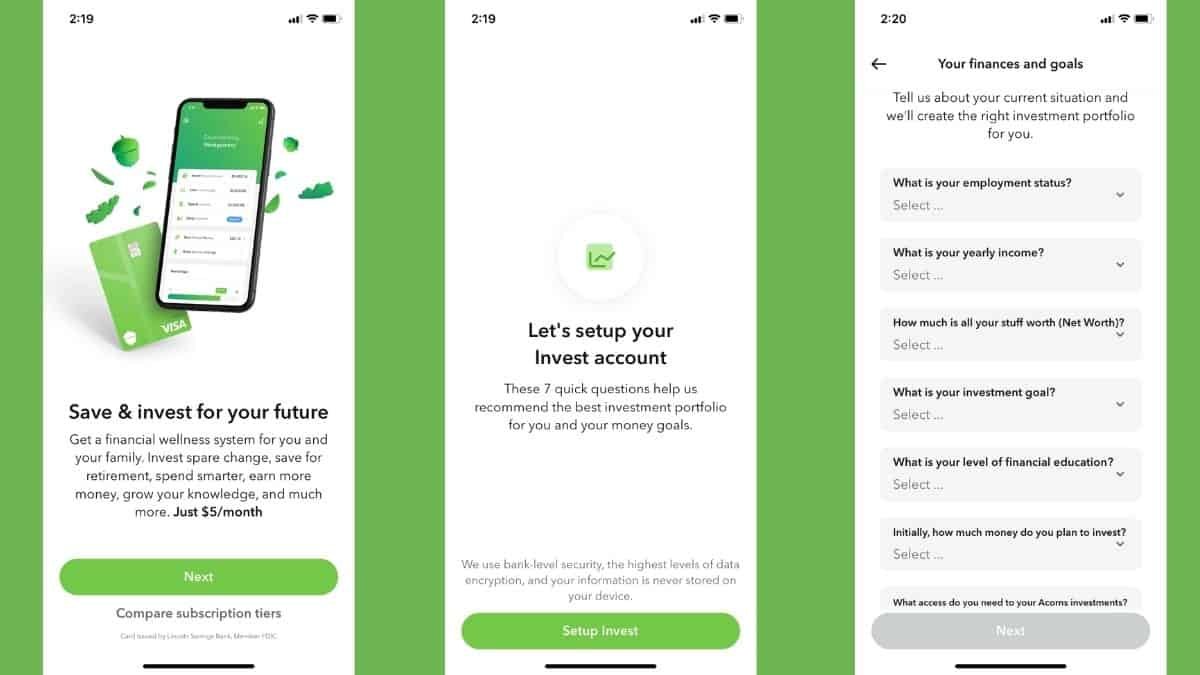

After downloading the investing app and establishing a person account, you’ll be directed to finish a brief survey to gauge your funding threat preferences and monetary targets.

Based mostly in your response, the Acorns laptop algorithm proposes a diversified portfolio that mixes a wide range of ETFs holding the securities suited to your parameters, from aggressive (principally shares) to conservative (primarily bonds).

In contrast to a purely DIY method, the Acorns funding app will robotically rebalance your portfolio as market costs fluctuate, making certain that your funding portfolio retains your required asset class allocation in keeping with your general funding technique.

Investing for Your Future

Up to now, it’s a lot the identical as you might need skilled with different robo-advisor providers.

The place Acorns Make investments diverges is within the numerous methods you may ship cash to your Acorns account for funding.

Along with one-off transfers, cell verify deposits, and usually scheduled direct deposit or recurring transfers out of your financial institution to Acorns, you may hyperlink your Acorns Make investments account to your debit card and bank card.

Doing so permits each spending transaction you make to be rounded as much as the closest greenback, with the “extra” deposited in your Acorns account.

For instance, your $78.56 complete on the grocery retailer checkout ends in a deposit of $.44 in your Acorns account out of your linked checking account.

(As a sensible matter, round-up transfers are grouped into batches of not lower than $5.00. You may also add an computerized multiplier to extend your round-up quantities.)

There’s additionally the power to earn additional funding by retailers allied with the Acorns platform who deposit a set quantity or share of your buy into your Acorns account.

You’ll earn bonus investments from retailers together with:

- Apple

- Groupon

- Kohl’s

- Nike

- Outdated Navy

- Sam’s Membership

- Sephora

- Walgreens

- and 350 extra

To be clear, the round-up characteristic will most likely not be the way you attain your dream of monetary independence.

However it’s (1) type of enjoyable and (2) could be the additional kicker that motivates somebody to turn out to be enthusiastic about investing who was probably not into the concept earlier than.

As an Acorns subscriber, I amassed about $500 in my Acorns account solely by round-ups over 11 months.

There isn’t a minimal stability to get began with an Acorns account. You should use Acorns to put money into a taxable (i.e., non-retirement) account or open an IRA by Acorns.

There’s additionally a choice of monetary literacy-themed blogs on the positioning, albeit considerably restricted.

Is There a Price to Use Acorns?

However in fact, every little thing has its value, and so does Acorns. Maybe that is the place Acorns falls brief.

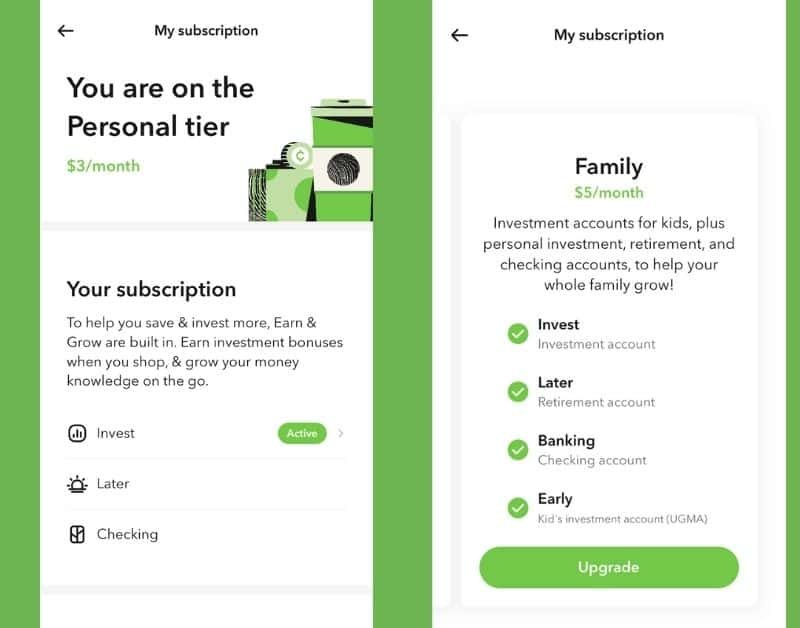

Whereas it launched with a month-to-month price of simply $1, the subscription value rose to $3 per 30 days final 12 months for the fundamental plan.

This price contains the power to arrange a non-retirement taxable funding account, a retirement account (IRA), and banking merchandise together with a checking account and debit card, do you have to want.

There’s additionally a $5 per 30 days Acorns Household plan possibility that permits you to have a number of separate accounts. Plus the power to open funding accounts for teenagers (UTMA/UGMA custodial accounts).

One apparent query: How does a $3 per 30 days price evaluate to what you would possibly pay for a robo-advisor funding account at a competitor? Listed here are a number of examples:

- At Vanguard, the robo-advisor service requires a $3000 funding to get began and an annual advisory price of .20% ($2.00 per $1,000 invested).

- Betterment has no minimal funding quantity and expenses a .25% annual price for his or her robo-advisor possibility.

- One other comparator is E*TRADE. Their robo-advisor possibility requires solely $500 to start and levies a .30% annual advisory price.

If we take these three examples as our metric, solely after amassing a stability of a minimum of $12,000 at Acorns would your $3 per 30 days price be as little as the most expensive different robo-advisor possibility.

Or, to state it one other approach, for low stability accounts, the month-to-month subscription for Acorn interprets to a comparatively excessive account service price. The month-to-month price is just aggressive when your stability has grown to 5 figures.

Talking with a human monetary advisor or receiving funding recommendation is just not an possibility with Acorns, whereas different corporations might provide that possibility.

Crypto Curious? Spend money on a Bitcoin ETF with Acorns!

Do you have to go together with the Acorns anyway, regardless of the price?

It’s essential to contextualize the $36 annual price.

Solely 53% of People personal inventory. And crucially, possession may be very extremely concentrated within the highest revenue brackets.

For those who’re uncomfortable with investing, Acorns is as pleasant because it will get. Its interface screams consolation meals with not one of the “bro-ness” of another platforms.

Acorns is a protected area to introduce newbies to considerate, long-term funding for these scared of the securities markets or intimidated by the lingo.

And on that observe, it’s regarding that, maybe inevitably, Acorns has introduced plans to introduce the power to commerce particular person shares on its platform. In response to the Monetary Business Regulatory Authority (FINRA),

“Whereas buying and selling has large potential for quick rewards, it additionally entails a fair proportion of threat as a result of a inventory might not recuperate from a downswing inside the time-frame you want—and will in reality drop additional in value. As well as, frequent buying and selling could be costly, since each time you purchase and promote, you might pay dealer’s charges for the transaction. Additionally, should you promote a inventory that you have not held for a 12 months or extra, any income you make are taxed on the similar price as your common revenue, not at your decrease tax price for long-term capital positive aspects.”

When taking every little thing into consideration, $36 could also be a really cheap value to pay if it brings somebody to the investing desk who in any other case wouldn’t have participated.

And with the power to earn more money by purchasing and referrals you could possibly fairly simply cowl a minimum of some value of the app.

For those who’re commitment-shy in terms of investing, or have a low threat tolerance, the round-up characteristic could be the inducement you want. Not simply to start out however to maintain going—including to your funding account usually and robotically.

Investing $500 in a 12 months solely by round-ups isn’t so much…however it’s so way more than zero.

Closing Ideas

I am now not an Acorns subscriber, and maybe therein lay a lesson. I joined Acorns in late 2020 (at $1 per 30 days) to interact in a little bit of market analysis.

Nonetheless, as I’ve a brokerage account elsewhere, there was no value-add to having an Acorns account moreover. And their funding choices weren’t completely different sufficient to make me need to transfer my account from its present house over to Acorns.

I believe that mine is just not a singular expertise; in case you have a low-cost funding account elsewhere with which you’re happy, you’re most likely unlikely to modify over to Acorns.

However should you (or somebody in your life) is searching for their first funding account expertise, Acorns – even with its price – is a horny approach for newbie traders to get began with out having to know every little thing in regards to the inventory market.

Get $5 whenever you join Acorns as we speak!